Fintech evolving rapidly, driven by advancements in blockchain and digital currencies. What once was a niche concept is now reshaping banking, payments, and global commerce. Blockchain offers transparency and security, while cryptocurrencies challenge traditional financial models. Together, they are transforming the way businesses and consumers interact with money.

1. Understanding Blockchain Technology

What is Blockchain?

A blockchain is a decentralized ledger that records transactions securely across a distributed network. Unlike traditional financial systems, blockchain does not rely on intermediaries. Transactions are verified through consensus mechanisms, ensuring integrity and reducing fraud.

Key characteristics:

- Decentralization: Eliminates central control, reducing dependency on banks.

- Transparency: Transactions are publicly verifiable, increasing trust.

- Security: Cryptographic techniques protect data from tampering.

- Immutability: Once recorded, information cannot be altered or erased.

How Blockchain Works

Transactions are bundled into blocks and verified by network participants. Once confirmed, blocks are added to a chain, ensuring a continuous and secure record of data.

Process overview:

- A transaction is initiated.

- Network nodes validate the transaction.

- A block containing the transaction is created.

- The block is added to the chain and permanently recorded.

- All participants update their copies of the blockchain.

Types of Blockchains

Different blockchain models serve different purposes:

- Public: Open to everyone, used in cryptocurrencies like Bitcoin and Ethereum.

- Private: Restricted access, favored by enterprises for internal transactions.

- Consortium: Shared among multiple organizations for collaborative efforts.

- Hybrid: A combination of public and private features, offering flexibility.

2. The Evolution of Cryptocurrencies

Bitcoin and Its Impact

Bitcoin emerged as the first decentralized currency, offering an alternative to fiat money. With a fixed supply and peer-to-peer transactions, it introduced a new financial paradigm.

Notable aspects:

- No central authority.

- Scarcity-driven value.

- Fast and low-cost cross-border transfers.

The Growth of Altcoins and Ethereum

Bitcoin’s success led to the rise of alternative cryptocurrencies. Ethereum pioneered smart contracts, allowing programmable financial agreements without intermediaries.

Prominent altcoins:

- Litecoin: Faster transaction speeds than Bitcoin.

- Ripple: Designed for international money transfers.

- Cardano: Focused on security and scalability.

- Solana: Known for high-speed transactions with low fees.

Stablecoins and Digital Currencies

To address volatility, stablecoins were introduced, pegged to traditional assets such as the US dollar.

Examples:

- Tether (USDT), USD Coin (USDC): Backed by reserves.

- DAI: Algorithmically controlled value stability.

Governments are developing Central Bank Digital Currencies (CBDCs) to integrate blockchain benefits into traditional monetary systems.

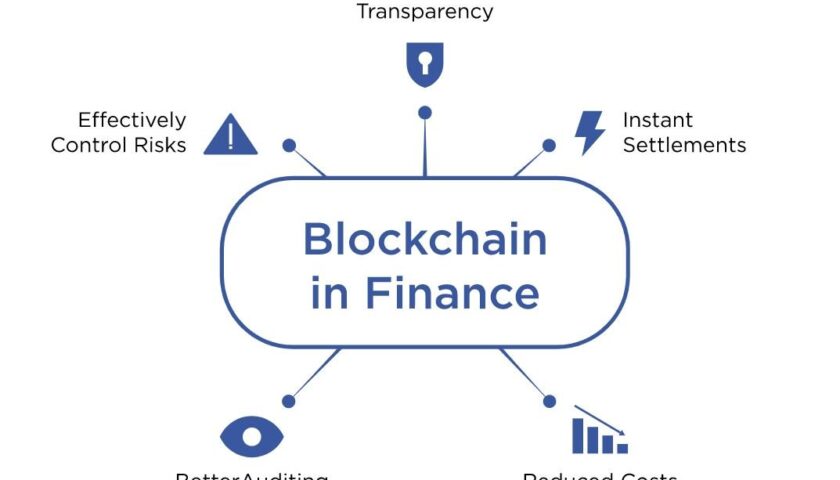

3. Blockchain’s Influence on Financial Services

Decentralized Finance (DeFi)

DeFi eliminates intermediaries, providing direct access to financial services. Users can lend, borrow, trade, and earn interest without relying on banks.

Key applications:

- Lending platforms such as Aave.

- Decentralized exchanges (DEXs) like Uniswap.

- Asset tokenization enabling digital ownership of real-world assets.

Enhancing Cross-Border Transactions

Traditional remittances involve delays and fees. Blockchain streamlines international payments by offering near-instant transactions at lower costs.

Projects leading this change:

- Ripple (XRP): Designed for financial institutions.

- Stellar (XLM): Focused on affordable global payments.

Strengthening Security and Fraud Prevention

Blockchain minimizes financial fraud by providing a transparent and tamper-resistant system. Identity theft, payment fraud, and unauthorized transactions decrease with distributed ledger technology.

Challenges remain in:

- Regulatory clarity: Governments are defining policies for digital assets.

- Scalability: Networks are working on reducing congestion and costs.

- Adoption: Awareness and education are essential for widespread use.

4. The Challenges of Blockchain and Cryptocurrency Adoption

Regulatory Uncertainty

Governments and financial institutions are still working to define clear regulations for blockchain and cryptocurrencies. The lack of global regulatory consensus has led to inconsistent policies across different countries, affecting adoption and investment.

Key regulatory challenges:

- Legal classification: Cryptocurrencies are treated differently depending on the jurisdiction—some view them as assets, while others classify them as securities or commodities.

- Taxation complexities: Determining how to tax crypto transactions and holdings remains a debated topic.

- Compliance with anti-money laundering (AML) laws: Many regulators require exchanges and crypto businesses to implement strict Know Your Customer (KYC) measures.

Scalability and Energy Consumption

Blockchain networks, particularly those using Proof of Work (PoW) consensus mechanisms, face significant scalability and energy consumption concerns.

Issues affecting scalability:

- Network congestion: High transaction volumes lead to delays and increased fees on popular blockchains like Bitcoin and Ethereum.

- Energy-intensive mining: PoW blockchains require large amounts of computational power, raising concerns about environmental impact.

- Layer-2 solutions: Innovations such as the Lightning Network and Ethereum’s Layer-2 rollups aim to improve transaction speed and reduce costs.

Security Risks and Fraud

Despite its security advantages, blockchain technology is not immune to cyber threats. Hacks, fraud, and vulnerabilities continue to challenge the industry.

Common security risks:

- Smart contract exploits: Bugs in code can be exploited by hackers, leading to financial losses.

- Exchange hacks: Centralized crypto exchanges are frequent targets for cybercriminals.

- Phishing and social engineering attacks: Users are often tricked into sharing private keys or login credentials.

Improving security requires better education, robust cybersecurity measures, and the development of more secure blockchain protocols.

5. The Role of Blockchain in the Future of Finance

The Evolution of Decentralized Finance (DeFi)

DeFi platforms are changing how financial services are accessed, making them more inclusive and removing the need for traditional intermediaries.

Key DeFi developments:

- Automated lending and borrowing: Users can access loans without credit checks through smart contract-based lending platforms.

- Decentralized exchanges (DEXs): Platforms like Uniswap and PancakeSwap facilitate peer-to-peer crypto trading without centralized control.

- Stablecoin integration: DeFi projects rely on stablecoins like USDT and USDC to reduce volatility and facilitate transactions.

Blockchain in Traditional Banking

Financial institutions are beginning to explore blockchain-based solutions to streamline operations and improve transparency.

Use cases for banks and financial institutions:

- Cross-border payments: Banks are testing blockchain networks to reduce transaction costs and settlement times.

- Trade finance: Blockchain is enhancing supply chain transparency and efficiency.

- Digital identity verification: Secure blockchain-based identity solutions can simplify KYC processes and reduce fraud.

The Growth of Non-Fungible Tokens (NFTs)

NFTs have expanded beyond digital art and gaming, influencing industries such as real estate, entertainment, and intellectual property rights.

New NFT applications:

- Tokenized real estate: Properties can be fractionalized and traded as NFTs.

- Music and entertainment: Artists use NFTs to distribute exclusive content and engage with fans.

- Luxury goods authentication: High-end brands implement NFTs to verify product authenticity.

6. The Future of Blockchain and Cryptocurrency Integration

Central Bank Digital Currencies (CBDCs)

Governments are exploring CBDCs as digital versions of fiat currencies. Unlike cryptocurrencies, CBDCs are centralized and controlled by monetary authorities.

Potential benefits:

- Faster transactions and lower costs compared to traditional banking systems.

- Greater financial inclusion by providing banking services to unbanked populations.

- Improved monetary policy implementation with programmable digital currency features.

Institutional Adoption of Cryptocurrency

Major corporations and investment firms are incorporating crypto into their financial strategies, signaling mainstream acceptance.

Notable trends:

- Companies adding Bitcoin to balance sheets: Tesla and MicroStrategy have invested billions in Bitcoin.

- Crypto-based investment funds: More hedge funds and asset managers are offering cryptocurrency portfolios.

- Payment integration: Merchants and online platforms are allowing crypto transactions.

The Evolution of Smart Contracts

Smart contracts are becoming more advanced, enabling new use cases beyond finance.

Upcoming innovations:

- Self-executing legal agreements: Automating contract enforcement in real estate and legal services.

- Decentralized insurance: Blockchain-based insurance policies with automated claims processing.

- Supply chain management: Smart contracts ensuring product authenticity and tracking.

7. Key Takeaways

Blockchain and cryptocurrencies are reshaping the financial landscape, offering solutions that improve efficiency, security, and accessibility. While challenges such as regulation, scalability, and security persist, continuous innovation is paving the way for broader adoption.

Businesses and investors who understand these developments can position themselves at the forefront of the digital finance revolution, leveraging blockchain’s potential to create new opportunities in payments, banking, asset management, and beyond.

SEO Meta Title:

Blockchain and Cryptocurrency: Overcoming Challenges and Shaping the Future of Finance